The Digital Hub

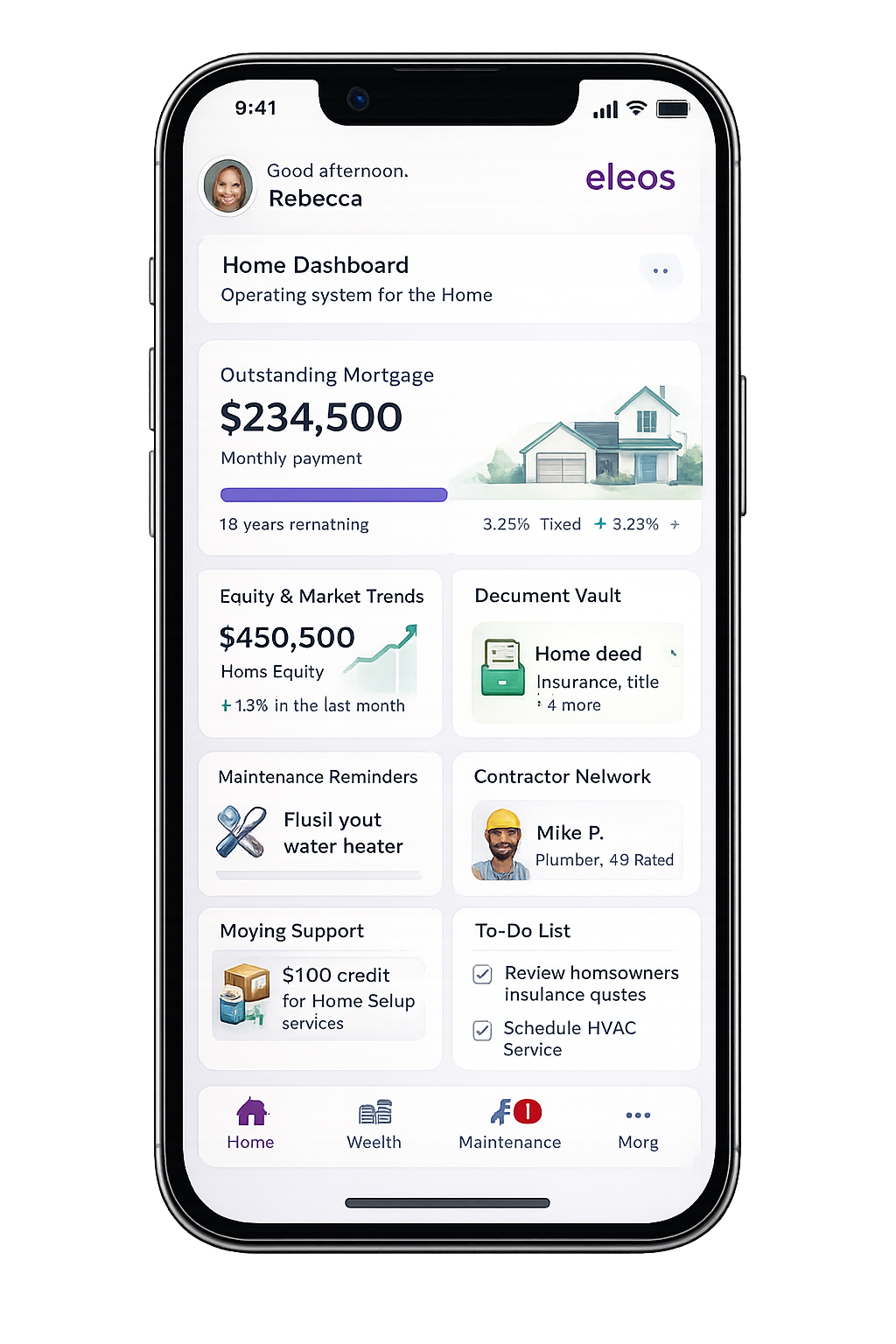

The "Operating System" for the Home

In the Concierge model, the Digital Hub is the primary interface that keeps the borrower "stuck" to the lender for the 7–10 years between transactions.

A Private Client Portal

This portal transforms the monthly payment interaction into a high-value property management session.

Homeowners can monitor their home value, equity growth, and local market trends in real-time.

Serves as a centralized, secure location for critical documents like deeds, title insurance, and active Homeowners Insurance policies.

The portal can trigger alerts when equity growth or market changes suggest a need to re-evaluate Home Insurance or Mortgage Protection Insurance (MPI) levels.

Physical Asset Management

Moving the lender from a "bill collector" to a "solution provider" ensures the home remains a healthy asset for both the borrower and the bank.

Borrowers receive seasonal maintenance reminders (e.g., "Time to flush your water heater") to protect the health of the property.

Connects homeowners directly to repair services, often integrated with Home Warranty coverage to streamline claims and repairs.

Proactive maintenance and integrated Security System monitoring align the brand with family safety and asset longevity.

The Logistical Anchor (The Engagement Engine)

By becoming the administrative center for the home, lenders create "demand complementarities" that make switching providers a complex administrative task.

Hubs include "Home Setup" services that manage the administrative burden of utility switching, broadband setup, and council tax.

Transforming the monthly login into an asset management session drastically increases the "stickiness" of the relationship.

Frequent engagement allows for the natural introduction of financial products—such as Disability Insurance or Life Insurance—during key "life event" windows identified through portal data.